Subscribers can listen to this article

Ozempic is marketed for the treatment of type 2 diabetes, while Wegovy is marketed for weight loss. (Steve Christo - Corbis/Corbis via Getty Images)

- The remarkable efficacy of new diabetes and weight-loss medicines like Ozempic and Mounjaro have been one of the biggest health stories in recent years.

- Despite rising rates of diabetes and obesity, access to these medicines remain limited in South Africa.

- Spotlight breaks down the availability and pricing of GLP-1 agonists in South Africa.

Ozempic and other glucagon-like peptide-1 (GLP-1) agonists are a transformative new class of medicines for the treatment of diabetes and obesity, while also delivering other health benefits, such as lowering the risks of heart and kidney problems.

While some people taking GLP-1 agonists experience difficult side effects, including nausea, vomiting and diarrhoea, and there is a need for more data on the impact of long-term use of these medicines, currently available data suggest that the benefits associated with GLP-1 agonists outweigh their risks.

In South Africa, these medicines remain largely inaccessible given their high costs, despite the large public health need for effective treatments for diabetes and obesity. For the few that can afford these treatments, supply disruptions are a major headache.

Pressure to broaden access to these medicines for public health purposes is mounting. The World Health Organisation (WHO) is now considering recommending these products in their global guidelines as essential treatments for diabetes and obesity care.

While the WHO decided not to recommend GLP-1 agonists for diabetes treatment in its 2023 Essential Medicines List (EML), it is likely that they will be recommended in the 2025 update, following an expert committee meeting in May. Inclusion on the WHO list puts pressure on governments to make medicines available and on companies to lower prices.

In addition to updating its EML, the WHO is currently developing guidelines for the use of GLP-1 agonists for obesity treatment, which are slated to be released in July. Scientists from the WHO recently wrote: "The approval of glucagon-like peptide-1 receptor agonists (GLP-1 RAs) for the treatment of obesity creates potential for a transformation of the whole health system that could halt and reverse the global obesity pandemic through prevention and effective integrated management."

Growing crisis

South Africa is grappling with dual diabetes and obesity epidemics, on top of the HIV and TB epidemics, but is not responding effectively, resulting in high obesity and diabetes-related deaths.

"[W]eight-related diseases have eclipsed tuberculosis and HIV as leading causes of morbidity and mortality in South Africa," says Dr Nomathemba Chandiwana and Professor Francois Venter from the Ezintsha Research Centre at the University of the Witwatersrand.

They explain in an editorial for the South African Medical Journal that evidence shows, on their own, recommendations for diet and exercise are unable to combat obesity and contribute to societal stigma and individual shame. Chandiwana and Venter argue that people need better, more supportive care, including access to GLP-1 agonists.

These medicines, they say, are most effective when combined with healthy lifestyle changes, adding that public reforms such as improving food labelling and affordable access to healthy foods are needed to support and enable people to make lifestyle changes.

An estimated 5.6 million people in South Africa are living with diabetes. While not all these people require GLP-1 agonists, they urgently require access to better treatments, including access to GLP-1 agonists. The country's reliance on outdated, difficult-to-use diabetes treatments contributes to poor diabetes outcomes and deaths.

An estimated 27% of adults in South Africa are obese in terms of the current body mass index-based (BMI) diagnostic criteria. A leading group of international researchers recently recommended new criteria that look beyond BMI to also consider the location of fat and its effects on health and mobility.

Access in SA

South Africa's Department of Health does not currently recommend the use of any GLP-1 agonists for the treatment of diabetes or obesity and these medicines are not available in the country's public healthcare sector.

Nevertheless, several GLP-1 agonists are registered in South Africa and can be purchased from private pharmacies with a doctor's prescription. However, the high cost of these medications and limited coverage by medical schemes, especially when used off-label, hinder their accessibility.

READ | Ozempic frenzy: South Africans chasing slim dreams fuel fake drug black market, put health at risk

Medicine is used off-label when it is prescribed to treat a condition that it is not registered to treat. Many GLP-1 agonists used for weight management are not yet registered for this use.

Spotlight has compiled a detailed breakdown of the availability and price of various GLP-1 agonists in South Africa. All prices were sourced from the Medicines Price Registry (except for Mounjaro) and include VAT and dispensing fees. The Mounjaro prices which were provided by Aspen include VAT but not dispensing fees.

Semaglutide

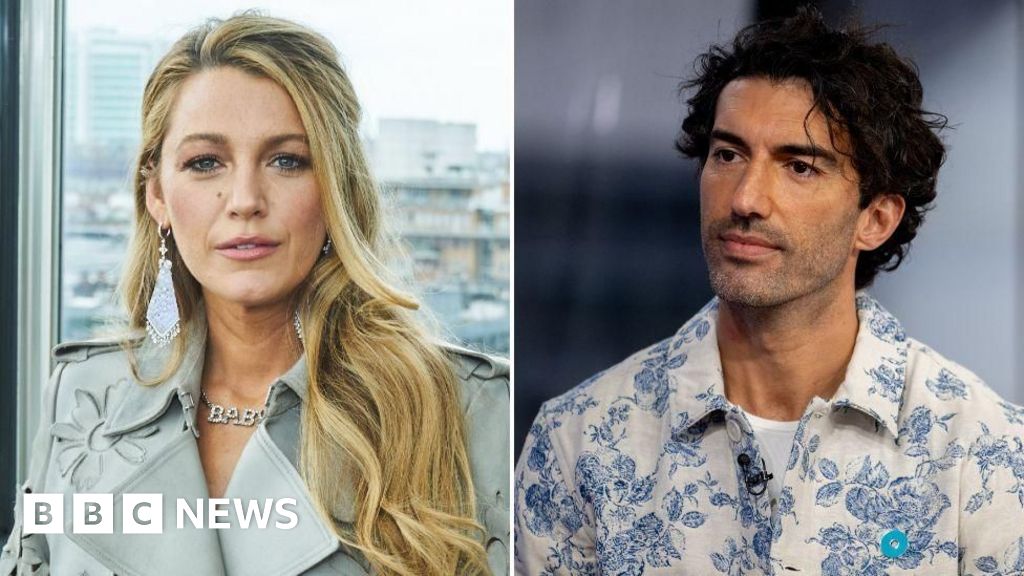

Semaglutide is probably the best known of the new GLP-1 agonists, with various high-profile celebrities reportedly having used the drug. Internationally, it is sold in three forms by the Danish pharmaceutical company Novo Nordisk: Ozempic, Wegovy and Rybelsus.

While all three forms have proven effective in achieving weight loss, Ozempic and Rybelsus are marketed by Novo Nordisk for treatment of type 2 diabetes, while Wegovy is marketed for weight loss.

Ozempic and Wegovy are both weekly injections. Ozempic is sold in injection pens containing 0.25 and 0.5mg doses, 1mg doses, and 2mg doses (the 2mg dose pens are not available in South Africa). Wegovy is sold in pens containing 0.25mg, 0.5mg, 1mg, 1.7mg or 2.4mg doses. Rybelsus is a tablet that is taken daily and is produced in 3mg, 7mg, and 14mg doses. These Wegovy and Rybelsus products are not yet available in South Africa.

The only registered semaglutide product that is currently sold in South Africa is Ozempic – specifically pens containing 0.25, 0.5, and 1mg doses. After completing starter doses, maintenance doses for type 2 diabetes range between 0.5 and 2mg weekly.

A pre-filled pen containing four weekly doses of 1mg Ozempic is priced between R2 700 and R3 100 per month (the price range accounts for dispensing fees that may be added by pharmacies on top of the price charged by companies).

Patients requiring 2mg maintenance doses must buy two Ozempic 1mg dose pens per month, bringing monthly prices to between R5 400 and R6 200.

In South Africa, Ozempic is only registered for treatment of type 2 diabetes and to reduce the risk of major adverse cardiovascular events, but it is also prescribed off-label for weight loss.

The South African Health Products Regulatory Authority (SAHPRA) has warned that potentially dangerous, falsified versions of semaglutide are being marketed in the country and urged the public to only use registered products sold at licensed pharmacies.

Wegovy has not yet been registered in South Africa. Rybelsus, the oral tablet form of semaglutide, was registered by SAHPRA in 2024 but is not yet sold in the country.

Novo Nordisk's Kamogelo Mmako told Spotlight: "We have not publicly announced launch timing for Rybelsus or Wegovy in South Africa."

Tirzepatide

After semaglutide, tirzepatide is probably the next best known GLP-1 agonist. It is sold in two forms – Mounjaro and Zepbound – by US pharmaceutical company Eli Lilly. Both products contain the same active ingredients and dosage formulations but are marketed under different brand names in the US for diabetes (Mounjaro) and weight loss (Zepbound).

According to Aspen's Stavros Nicolaou, in most countries outside of the US, including South Africa, Mounjaro is marketed for both type 2 diabetes and weight loss. Aspen has a marketing agreement with Eli Lilly for the sale and distribution of tirzepatide in Sub-Saharan Africa and announced the launch of Mounjaro in South Africa in December 2024.

Mounjaro is registered by SAHPRA for the treatment of type 2 diabetes. Its use for weight loss in South Africa is currently off-label.

Nicolaou said:

Eli Lilly has made an application to SAHPRA for the chronic weight-loss indication for Mounjaro and this is pending SAHPRA review.

Mounjaro is sold in pens containing 2.5mg, 5mg, 7.5mg, 10mg, 12.5mg, and 15mg doses. Each pen contains a single-use dose and must be taken weekly. Single-dose 2.5mg and 5mg pens are priced at R880, while 5mg and 10mg pens are priced at R1 140.

After completing starter doses, a weekly maintenance dose of 5mg, 10mg, or 15mg may be given depending on the patient's needs and response to treatment. A month's supply of a 10mg maintenance dose is priced at around R4 600.

Liraglutide

Liraglutide is marketed by Novo Nordisk in three formulations: Saxenda, Victoza, and Xultophy. All three products, which are taken as daily injections, are registered and sold in South Africa.

Victoza and Saxenda both have the same active ingredient (liraglutide), but their pre-filled pens deliver different dosages. Victoza and Saxenda pens both deliver 0.6mg, 1.2mg, or 1.8mg doses, while Saxenda pens also deliver higher doses of 2.4mg and 3mg. Xultophy is a combination of insulin and liraglutide and is used for treatment of type 2 diabetes.

Victoza is registered in South Africa for type 2 diabetes treatment, while Saxenda is registered for chronic weight management. Saxenda is the only GLP-1 agonist registered for weight management in South Africa. (There are other medicines registered for obesity treatment in South Africa, but they do not fall into the GLP-1 agonist class. These medicines include orlistat, phentermine and topiramate, and naltrexone/bupropion).

A typical Victoza maintenance dose of 1.8mg daily is priced between R2 800 and R3 200 per month, while a month of Saxenda at 3mg daily maintenance doses is priced between R4 500 and R5 000.

Generic versions of Victoza and Saxenda are now available in some countries, but no generic liraglutide products are yet registered and available in South Africa. Novo Nordisk is reducing production of Victoza and discontinuing supply in some markets to increase its production capacity for Ozempic.

"Victoza is still currently available in South Africa, however, we are constantly evaluating our portfolio. Before we make any changes, we notify the Ministry of Health and SAHPRA and will work to ensure continuity of care to as many patients as possible," said Mmako.

Dulaglutide

Dulaglutide is marketed by Eli Lilly under the brand name Trulicity for the treatment of type 2 diabetes and is registered for this use in South Africa. It is marketed by Aspen through a distribution and promotion agreement with Eli Lilly.

In South Africa, Trulicity is sold in packs containing four single-dose injections of 1.5mg. These packs are priced between R1 600 and R1 900. Weekly maintenance doses of Trulicity range between 1.5mg and 4.5mg, depending on the patient's needs and treatment response.

Lixisenatide

Lixisenatide is sold by Sanofi under the brand name Soliqua. Soliqua contains a combination of lixisenatide and insulin. It is registered for the treatment of type 2 diabetes in South Africa. A month's supply of a daily maintenance dose containing lixisenatide and 30 units of insulin glargine (a synthetic form of insulin) is priced between R2 700 and R3 300.

Exenatide

Exenatide was the first GLP-1 agonist brought to market for the treatment of diabetes. It was launched in the US by the pharmaceutical company AstraZeneca under the brand name Byetta in 2005. It was later marketed in a long-acting form under the brand name Bydureon BCise.

Byetta was registered for use in South Africa in 2008. AstraZeneca announced the discontinuation of Byetta and Bydureon BCise as newer, more effective products have come to market.

"Byetta was discontinued in the South African market as of February 2024. Additionally, Bydureon BCise has not been launched in South Africa," AstraZeneca's Sarah Sakr told Spotlight.

Medical aid coverage

Spotlight requested details on the coverage provided to medical scheme members for GLP-1 agonists for the treatment of type 2 diabetes and obesity from Discovery and Momentum.

Dr Noluthando Nematswerani, chief clinical officer at Discovery Health, said the GLP-1 agonists (Ozempic, Trulicity, Victoza, Mounjaro, Soliqua) registered by SAHPRA for the treatment of type 2 diabetes are covered under certain conditions.

"For members on all Discovery Health Medical Scheme plan types (excluding the KeyCare Series) who are registered for Type 2 Diabetes Mellitus, GLP-1 agonists are funded by the scheme from the Chronic Illness Benefit when the scheme's clinical criteria for GLP-1s are met. If the criteria are not met, these medicines are funded from the member's available day-to-day benefits (medical savings account and above threshold benefit)."

With regards to coverage for obesity, Nematswerani said: "Only one GLP-1 is registered for obesity in South Africa – liraglutide (Saxenda). It is funded from the member's available day-to-day benefits, subject to the rules of their chosen plan type."

Momentum did not respond to Spotlight's request for details on their GLP-1 agonist coverage for scheme members.

*This article was published by Spotlight – health journalism in the public interest. Sign up to the Spotlight newsletter.

Discover the Truth

Step into a world where the truth shines bright, and every headline is worth your time. With News24, you're not just reading the news; you are part of a community that values knowledge and insight. Immerse yourself in compelling stories, sharp analyses, and content that keeps you ahead of the curve.

Next on News24

Only 18 families respond to identify 75 decomposed bodies of Stilfontein zama zamas

10 Feb

(1).png)

18 hours ago

2

18 hours ago

2