Getty Images

Getty Images

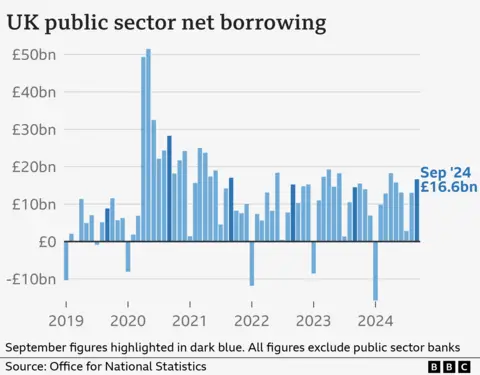

Government borrowing rose last month, marking the third-highest September since records began in January 1993.

Official figures show that borrowing - the difference between spending and tax revenue - reached £16.6bn last month.

The Office for National Statistics (ONS) said the figure was £2.1bn more than September last year.

This is the last official set of public finance figures until the Budget next week, with the Treasury expected to change its own self-imposed debt rules.

The monthly figure was lower than expected by economists, who had collectively predicted borrowing of £17.5bn for September.

"While tax revenue increased, this was outweighed by increased spending, partly due to higher debt interest and public sector pay rises," said Jessica Barnaby, deputy director for public sector finance at the ONS.

However, the figure is still higher than was previously forecast by the Office for Budget Responsibility (OBR), which monitors the UK government’s spending plans and performance.

Chief Treasury Secretary Darren Jones said the new Labour government had inherited a fiscal "black hole" from the previous government and that resolving this "will require difficult decisions" in the Budget next week.

The increased borrowing means the UK's national debt now stands at 98.5% of its economic output, a slight drop from last month but still around levels last seen in the early 1960s.

(1).png)

2 months ago

13

2 months ago

13